How we started getting serious about simple living.

This post is part 1 of a five-part series on frugal living. Click HERE to find the other posts in this series.

Let’s face it, a simpler life is not as “simple” as it sounds. At least not at first. Figuring out where to start simplifying your finances can lead you down a rabbit hole of multiple internet searches, podcasts downloads or even questionable YouTube advice. Friends or family might be a little too close for comfort to ask. And can you actually afford a financial planner?

Everyone’s financial journey is different. No one has the same ideal for simple living. Even my husband and I, coming from different financial backgrounds, have occasionally disagreed on how frugal we need to be.

When we first decided to simplify our lives, some things came easy like selling extra unused items on Craigslist and having a garage sale. The less stuff the better, right? We both enjoy home cooking so not eating out was also an easy frugal option.

However, being frugal seemed more difficult once we decided to homestead. All of a sudden, we needed MORE stuff to start homesteading such as:

- Purchase of a home with a few acres

- Seeds and plants to grow our own food in our garden

- Livestock animals such as chickens and pigs

- A few cats and dogs

- A small tractor

- Outbuildings including a garden shed and chicken coop

Could we make it a financial reality, or was it only homestead dreaming?

We realized it was time to get serious about simple living.

Our Frugal Journey Begins

One Sunday night, we sat at the kitchen table and wrote down all the reasons we wanted to homestead and live a simpler life. We looked at the money coming in and going out. Where were we at financially? Where were we going? We made lists, broken down into categories such as food, transportation, new house, etc. That first meeting was overwhelming. We set our written ideas aside and agreed to sit down again next Sunday to better prioritize our goals.

During that first week, Mike found some great goal-setting advice that we continue to use. When we sat down the following Sunday, he was ready with a plan for us to put into action.

Here are the five steps we used to set goals:

- What is our goal?

- Why do we want to achieve this goal?

- What will this goal cost us?

- How will we achieve this goal?

- When will we achieve this goal?

For example, one of our goals is building a garden shed. We wanted to achieve this goal to provide storage for gardening supplies and for Mike and I to practice building skills. We researched building plans and determined a cost for materials. We would achieve this goal by having Mike build the shed with some assistance from me. We would complete this goal by late fall of 2020.

We then took all of our goals and sorted them into three categories: Long-term, mid-term, and short-term.

Long-term for us is anything two years from now and into retirement such as buying our next home. Mid-term is anything within the next six to eighteen months. A pressure canner and vacuum sealer for preserving our food are on that list. Our short-term goal list includes anything from today through the next six months. This would include our new garden shed. Having all of these goals written down would help us with our monthly budgeting.

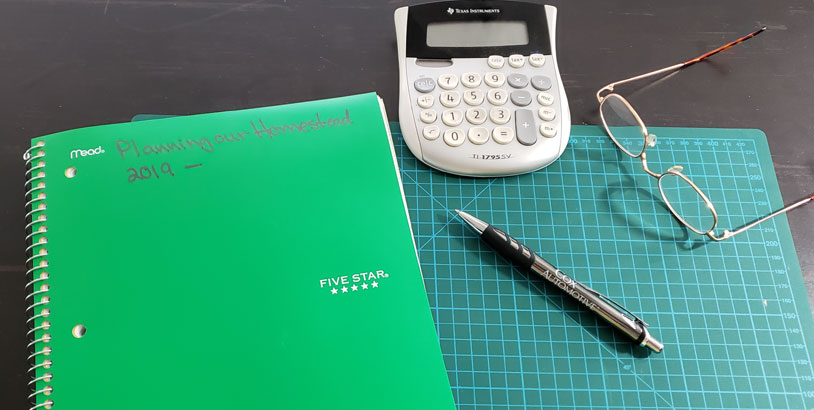

It was at that meeting that we decided to sit down every Sunday night and work on our finances and goals together. I found a spiral notebook and started making notes, wrote down our lists and goals. We set up a table in my craft room where we could conduct these meetings. I turned my marker board into a “Future List.” We could write down things we wanted in the future that we could turn into goals.

We also decided at that meeting we needed to adopt better spending and saving habits. It was time for us to learn better budgeting skills.

We started with three primary goals:

Learn Our Spending Habits

We realized right away that we needed to practice better spending habits. We had started our homesteading plans based on simple living. Part of simple living included simplifying our finances. Things like rent, utilities, vehicle payments, credit card payments, etc. were always coming due. Where could we cut out expenses? Our major financial goal was to buy some rural land outside the city. How could we save money for that and for our other goals?

Our Sunday meetings started getting serious as we worked on our budget. We found a budgeting spreadsheet that we liked and adapted it for our needs. Tips and advice are plentiful online and we did some searching for a while to find what worked for us. We also bought Dave Ramsey’s book The Total Money Makeover and we’re working our way through it.

We started tracking every expense, learning how to do zero-based budgeting. All of our receipts from our purchases we saved. All of our Amazon purchases were easy to find on its website to either print out or save as a spreadsheet. Cash purchases were written down and put with the receipts. I regularly entered that data into our budgeting spreadsheets.

Another thing we learned was to build an emergency fund. Having money set aside for unexpected events such as job loss or medical problems is essential.

Cutting Out Unnecessary Expenses

We took a hard look at our spending and saving habits and realized there were a lot of ways we could improve. How necessary was our large house, expensive vehicles and many credit-card purchases?

The two-story house we were renting was obviously a good place to cut back. We moved into a less expensive one-story house in a different neighborhood, cutting our rent payment by a good amount.

Our two vehicles were the next project. Over a period of time, we were able to get rid of our cars and their expensive payments then paid cash for two older vehicles. Mike was skilled enough to make needed mechanical upgrades. We plan to have these two vehicles for many years.

Cutting the credit cards was a challenge. Not having them and only paying cash or debit really made us think twice about purchases. It is good self-discipline. We also realized how much we were spending on things we really didn’t need. We began practicing what we call “needs and wants” purchasing. Every purchase had to provide for a “need”, not a “want.” We asked ourselves: “Do we really need this or is this something we want?” We also learned to ask ourselves: “Where does this fit in the budget?”

Those questions and holding each other accountable have helped us a lot when cutting out unnecessary expenses.

Even though we had cut down or deleted some major payments, we knew we needed to find even more ways to save money such as:

- No cable TV and streaming subscriptions

- Wash our vehicles at home instead of at the car wash

- Look for sales and use coupons – avoid paying full price

- Avoid impulse shopping – keep to a list

- No “keeping up with the Joneses” – live OUR lifestyle OUR way!

Start Saving

All of these small changes we’ve made are adding up into big savings. We are more mindful of our purchases. Having goal lists has been a huge help for focusing on savings. We’re putting money aside to meet our goals.

Our Frugal Journey Continues

Learning how to set goals and manage a budget has been a real game changer. We’re finding it easier to save and spend our money. We hold each other accountable with our needs/wants thinking.

Discussing finances isn’t stressful because we have it all planned out. Every Sunday night we’re sharing ideas, dreaming of the future together and creating plans to make it happen. It’s a combined team effort.

We’re not “keeping up with the Jones” anymore. We drive used vehicles, we live in a small house, we do our own yard work. That might not seem unusual to some, but compared to the lifestyle of many in the surrounding neighborhoods it’s a big deal. Yes, compared to how we used to live less than a year ago, it’s a very big deal.

How frugal are your finances? What kind of goals have you set? How are you pursuing your lifestyle?

We hope our experiences can give you some inspiration for creating YOUR more frugal homestead.

Check out my post Frugal Living Around the Homestead with tips and ideas for things you can do in your home to save money and live simply.

~Alisa

[…] Before you begin practicing homesteading, you’ll need to set goals for your homestead. This is the first thing my husband Mike and I did when we decided to start homesteading. You can read how we set goals in part one of our Frugal 5 Series: Frugal Finances. […]